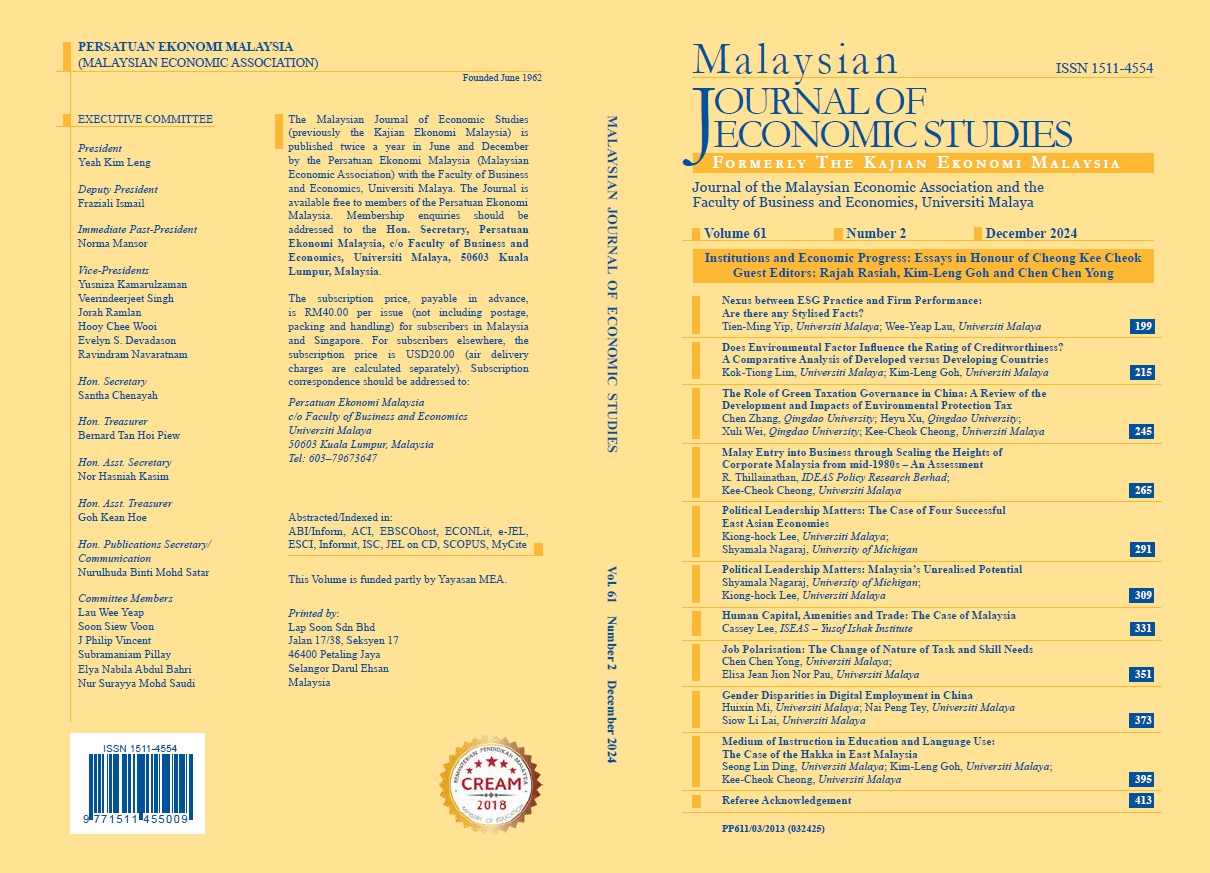

The Role of Green Taxation Governance in China: A Review of the Development and Impacts of Environmental Protection Tax

DOI:

https://doi.org/10.22452/MJES.vol61no2.3Keywords:

Environmental protection tax, environmental performance, double-dividends, innovation, ESGAbstract

The initiatives from China’s “ecological civilisation construction” to “promoting the modernisation of harmonious coexistence between man and nature”, and then to the dual-carbon goal of “carbon peaking – carbon neutrality”, highlight China’s firm determination to promote green development further. On January 1, 2018, the Environmental Protection Tax Law of the People’s Republic of China was officially implemented as the first new green tax focused on environmental governance in China. This marks the formal entry of China’s environmental protection into the tax era and the establishment of a green tax system with environmental protection tax (EPT) as the core. By a comprehensive review of the development, multi-dimensional effects and tax optimisation paths of China’s EPT, this paper hopes to provide an important reference for government departments to improve the construction of the green tax system, for enterprises to enhance their green governance capabilities, and for scholars to extend the study of the green tax system.