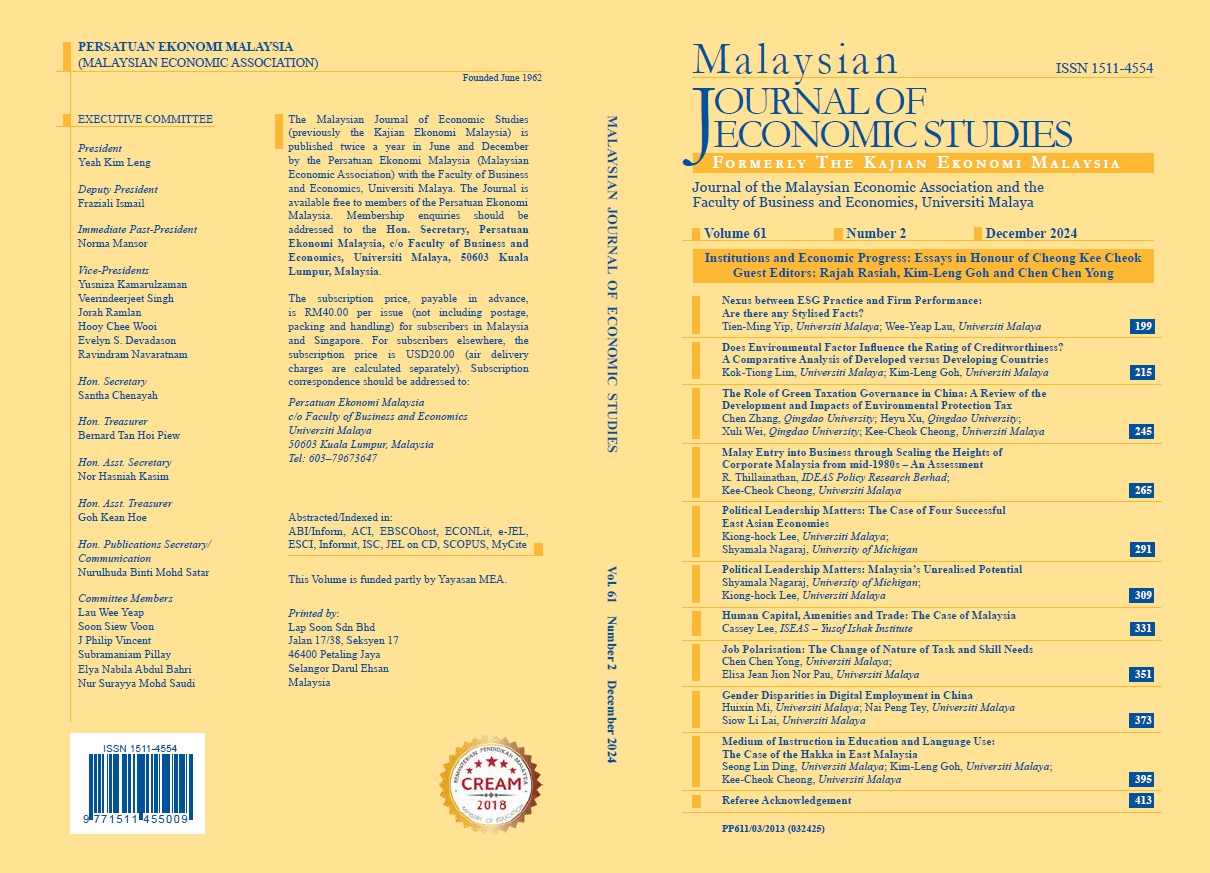

Nexus between ESG Practice and Firm Performance: Are there any Stylised Facts?

DOI:

https://doi.org/10.22452/MJES.vol61no2.1Keywords:

Environmental, social and governance (ESG), Tobin Q, corporate finance performanceAbstract

This study examines the relationship between firm performance and ESG (environmental, social and governance) practice for Malaysian public-listed companies. It evaluates whether the relationship varies with firms’ market capitalisation, total liabilities, and free cash flow. Using firm-level data from 72 companies covered in the FTSE4Good Bursa Malaysia (F4GBM) index from 2014 to 2022, our results show the following. First, ESG practice is positively and significantly associated with firm performance. However, the positive impact is conditional on the firm-specific variables. In particular, the positive impact of ESG is significant for firms with high market capitalisation. Second, the positive impact of ESG diminishes as firms accumulate higher liabilities. Third, the positive impact of ESG prevails if firms attain a high level of free cash flow. Our results suggest that firms must increase their market capitalisation, reduce total liabilities, and improve their free cash flow to benefit from ESG practices.